Investment gold: why buy it now

The physical gold is the “safe haven asset” par excellence, and in a period of strong social and political instability as the one we are living, it is important to know how to recognize the value. Discover with us why investing in gold is simple and profitable and can generate important positive effects on the economic well-being of your family.

Gold quotation: how does it work?

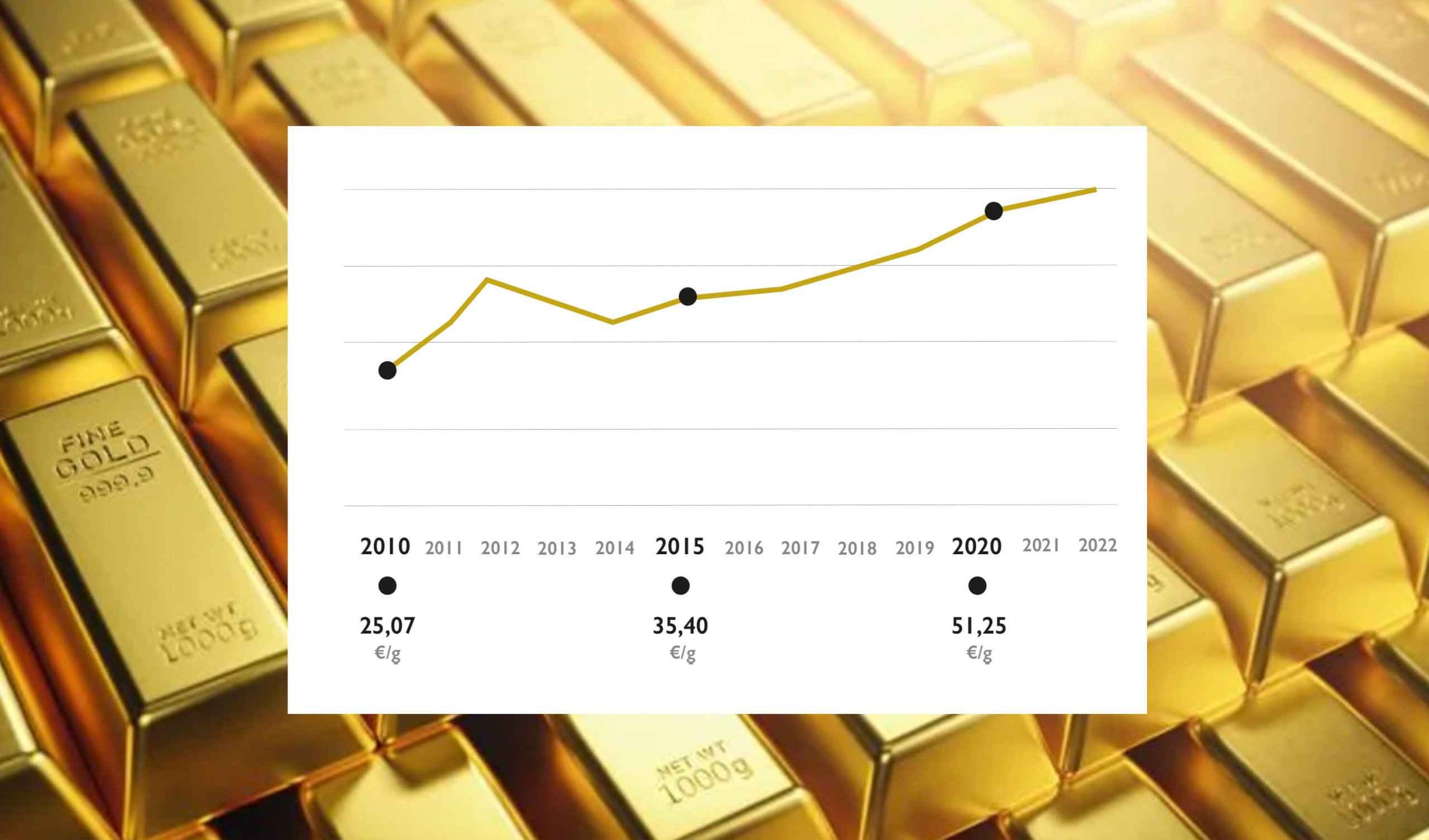

In March 2022, the value of gold reached an all-time high with a gold price per gram of over 60 euros and then recovered to 56 euros. Only three years ago, the most optimistic analysts did not dare to venture higher numbers than 1400 dollars per ounce, a figure largely exceeded by the current 1900 dollars.

The value of gold, therefore, is not fixed: what determines it is its demand, which is closely linked to the “safe haven” nature of this metal and tends to rise whenever political, economic or social crises occur. At the financial level, moreover, the gold quotation per gram is affected by the trend of the American dollar. The reference currency for the purchase and sale of this metal of excellence. The relationship between the two values is inversely proportional. When the power of the dollar goes up, the price of gold goes down (and vice versa).

Gold investment: why choose it?

As anticipated at the outset, the salient features of this moment in history strongly urge us to invest in gold although this type of asset tends to be favorable even in periods of less uncertainty. Here are five key reasons why everyone should consider investing in gold:

Gold protects against inflation

Historically used as a monetary reserve, gold is portable and divisible. Indestructible, recognizable and usable as a form of payment, this unique metal has proven to maintain its value in times of crisis as well as in times of prosperity.

Gold is the most solid of the safe haven assets

Throughout history (including recent history), national currencies have been victims of major fluctuations influenced by politics. Investing in gold, as a result, means sheltering your capital from severe fluctuations that could result in large losses.

Gold has high liquidity

Gold is one of the most easily spendable economic assets in the world. Sellable 24/24h in every part of the globe, it differs significantly from most other types of investment.

This metal allows you to diversify your portfolio

Gold lends itself to any style of investment, from the most cautious to the most aggressive. Its inverse correlation with the performance of stocks and bonds, moreover, means that those who also invest in gold can keep a portion of their investments safe from possible precipitation.

Exemption from VAT and no obligation to make a declaration

In Italy, private citizens are free to purchase physical gold for investment with exemption from VAT and have no obligation to declare until a resale takes place.

Where to buy investment gold?

To invest in physical gold you will need to deal with a Professional Gold Operator (OPO), the only professional with the necessary licenses to sell gold bars and coins. To consult the list you can click here.

For more than ten years, Ledial has been authorized by the Bank of Italy. Ledial is able to offer the best market conditions combined with an extremely professional consulting service. And if you want to resell your ingots, Ledial guarantees the repurchase with immediate credit. You can choose the ingot that best suits your needs: from 5 g up to 1 kg. Would you like to know how much gold costs per gram today? Check out our real-time gold price by clicking here.